TAX RATE Scale rate On the 1st RM20000 15000 On the next RM9920 3 29760 Tax payable 44760 11 marks ii. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

For instance in the UK the sugar tax or levy introduced in April 2018 applies where the sugar content of drinks exceeds 5 grams per 100 ml.

. This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021. The rate increases where the sugar content exceeds 8 grams per 100 ml. The penalty rate of 10 will apply which will increase the amount due to RM275000 RM250000.

The fees paid to B Ltd for the services was RM100000. Maximum tax rate for individual is 26. A Company in Malaysia is subject to income tax at the rate of 24 based on law stated as at 2019.

The proposal is effective from 1 April 2019. Box 10192 50706 Kuala Lumpur Malaysia Tel. Want to know more about SDN BHD company you can check out this guide on Sdn Bhd and how to register Sdn Bhd Company in Malaysia.

Corporate tax Malaysia is liable to be paid by the resident company Sendirian Berhad and Berhad or Sdn Bhd. Effective date Year of Assessment YA 2020 and subsequent YAs Changes to Individual Income Tax Rates Highlights of 2020 Budget Gross income RM Chargeable income RM Current Tax Rate 2019 Proposed Tax Rate 2020. Because sdn bhd company is taxed separately from their owners and the corporate tax rate is generally lower than the individual tax rate.

Here Janet can calculate the amount of salary she could pay herself from JM to obtain the best tax benefit possible. Following table will give you an idea about company tax computation in Malaysia. With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million.

The current CIT rates are provided in the following table. Advise the management of ASB on the tax implication on the disposal of i. Paid-up capital up to RM25 million or less.

Published by PricewaterhouseCoopers Taxation Services Sdn Bhd 464731-M Level 10 1 Sentral Jalan Rakyat Kuala Lumpur Sentral PO. On the First 50000 Next 20000. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

For non-resident individuals the applicable tax rate is increased by 2 to be in line with the changes which is 30. The issued share capital of ASB and DSB Sdn Bhd is RM26 million and RM24 million respectively. Sugar taxes or soda taxes as they are sometimes called are not unique to Malaysia.

RM38750 RM38750 RM37500 RM37500 RM25000 RM25000 RM25125 RM25125 RM38750 RM250000 x 10 RM275000 x 5 Tutorial note. Foundingbird Sdn Bhd 201901035214 1344544-U 7-2 Plaza Danau 2 Jalan 2109f Taman Danau Desa 58100 Kuala Lumpur Malaysia. On the First 20000 Next 15000.

1 Report to PandaiBuat Sdn Bhd From Tax Firm To Mr Bok Chek Wai Chief financial officer PandaiBuat Sdn Bhd. Currently the corporate tax rate for companies have less than 25 million share capital are as follows. Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less.

However if you qualify as a small medium enterprise SME the first RM600000 of chargeable income will subjected to a lower rate of 17 with the remaining balance taxed at the rate of 24. Company with paid up capital not more than RM25 million. B Installation and commissioning services.

25000002500000 over the YA 2019 export sales. What is the late payment penalty payable by TK Sdn Bhd in respect of the income tax paid on 15 June 2019. However there is a non.

ASB and DSB have the same accounting year end ie. Rate TaxRM 0 - 2500. Tax Rate of Company.

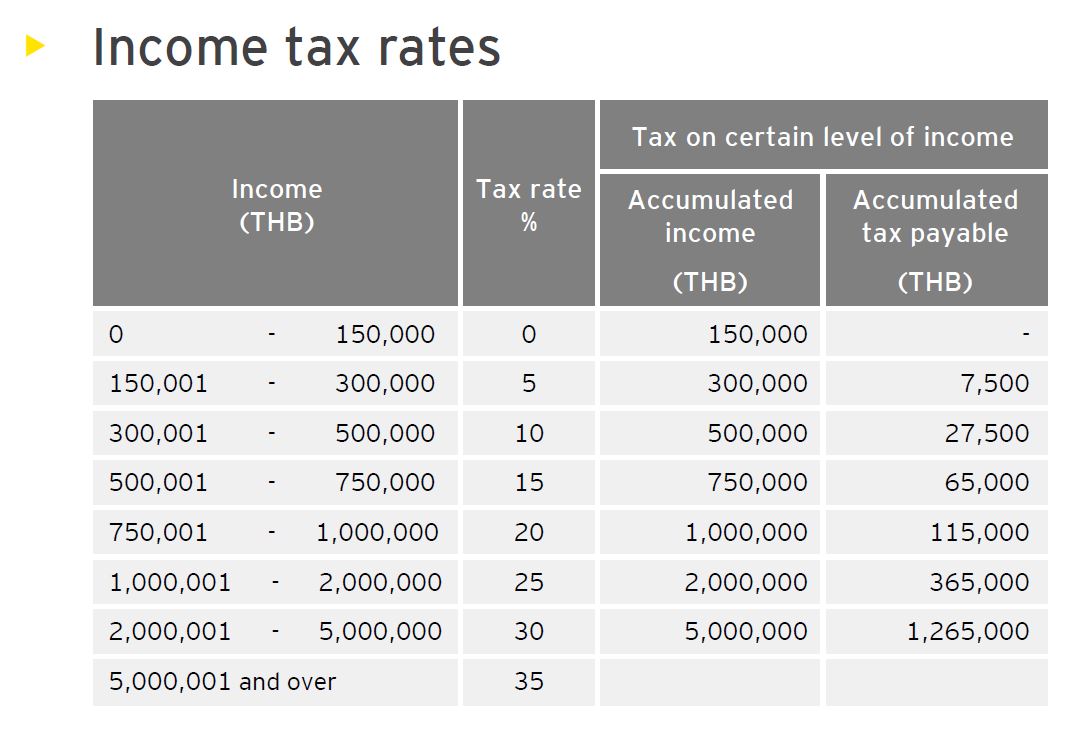

Income Tax Brackets and Rates. Rate On the first RM600000 chargeable income. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly.

Supervise the installation and operation of the plant from 1542019 to 3152019. Headquarters of Inland Revenue Board Of Malaysia. On the First 2500.

The rate of the AIE for PBSB will therefore be 10 of the value of increase in export sales in YA 2020 over that of the preceding year YA 2019. These proposals will not become law. In Order to Get the Most Tax Benefits Janet Media Sdn Bhds Income Should Stay Below the 17 Tax Bracket.

30 June each year and subject to the same corporate tax rate. On the chargeable income exceeding RM600000. A Sdn Bhd bought a power plant from B Ltd a company resident in India.

If Jagdit was not domiciled in Malaysia at the time of his death the income tax liability of the executor will be higher because. Compargo Malaysia Sdn Bhd 201301020939. Coming back to the tax exemptions and reliefs these are all the ones that were announced by the government during the 2022 Budget speech.

Tax under section 109B of the ITA at the rate of 10. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1.

First RM500000 profit 20. The executor will not entitle to the special relief of RM9000. Above RM500000 profit 25.

Malaysia Non-Residents Income Tax Tables in 2019. Such companies must be receiving gains or profits while running their businesses in Malaysia. On the first RM 600000 chargeable income.

Per LHDNs website these are the tax rates for the 2021 tax year. 20192020 Malaysian Tax Booklet. Heavy plant and machineries to an unrelated.

On the First 5000 Next 5000. On the First 10000 Next 10000. On the First 35000 Next 15000.

You can calculate your taxes based on the formula above and just make sure your total income in the first column comes up to.

Taxplanning So You Want To Start Your Own Business The Edge Markets

Income Tax Malaysia 2018 Mypf My

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Company Tax Rates 2022 Atotaxrates Info

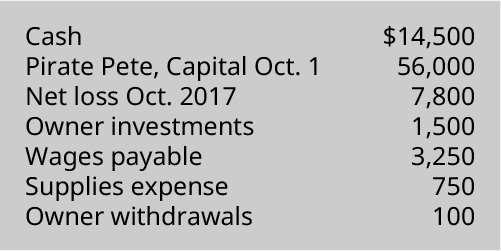

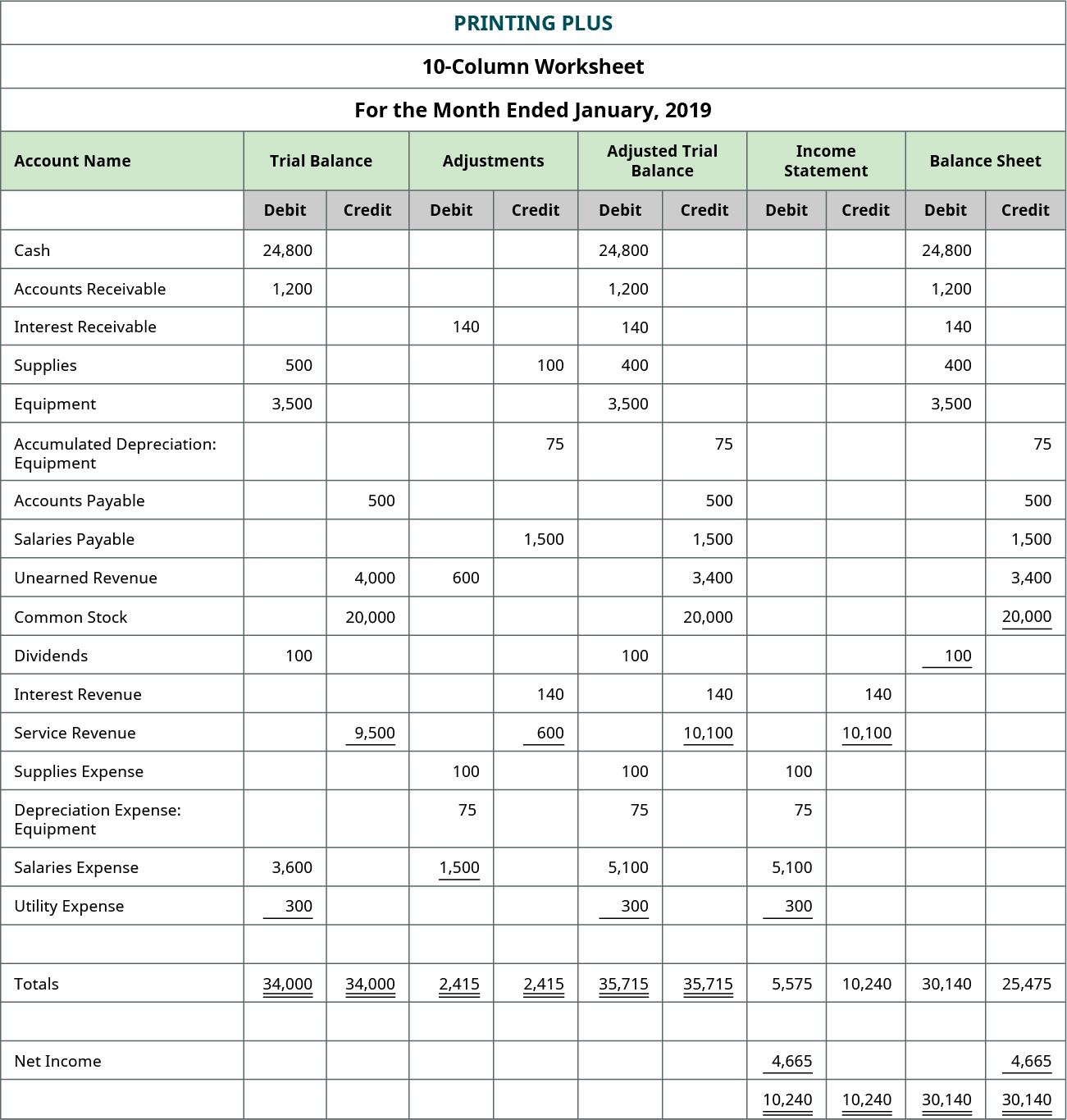

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

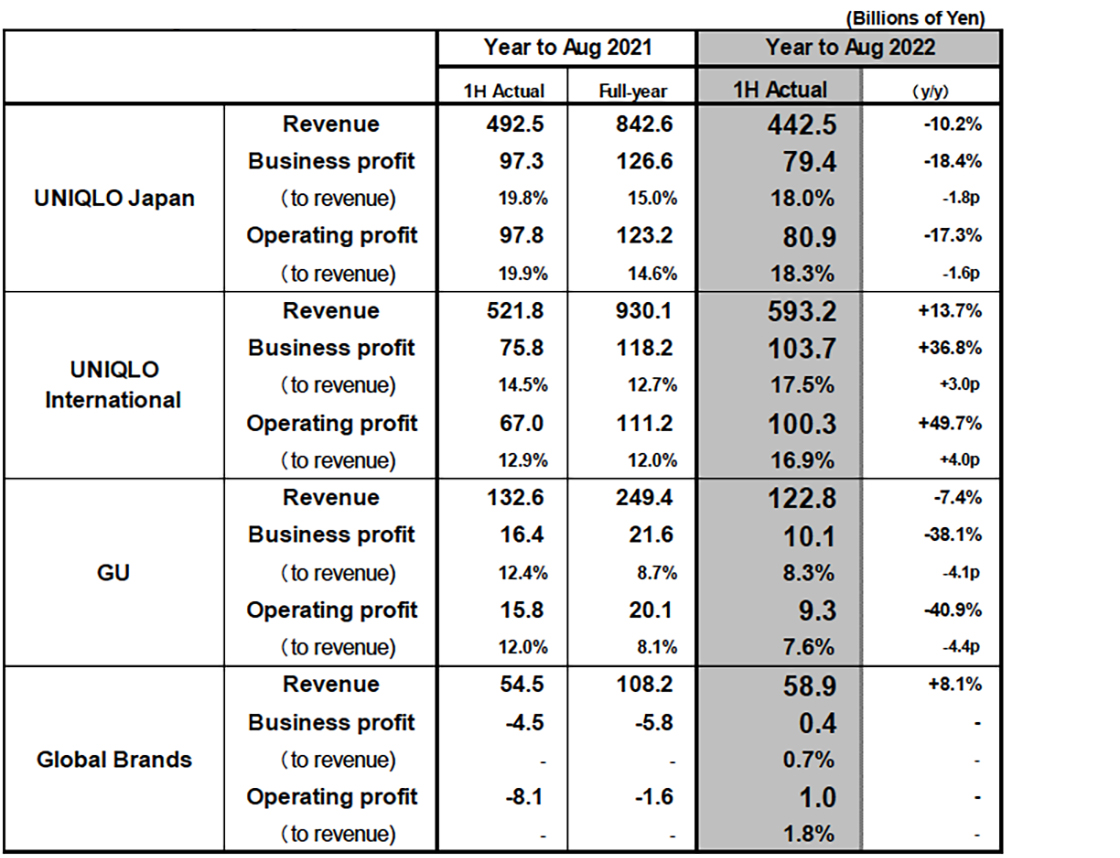

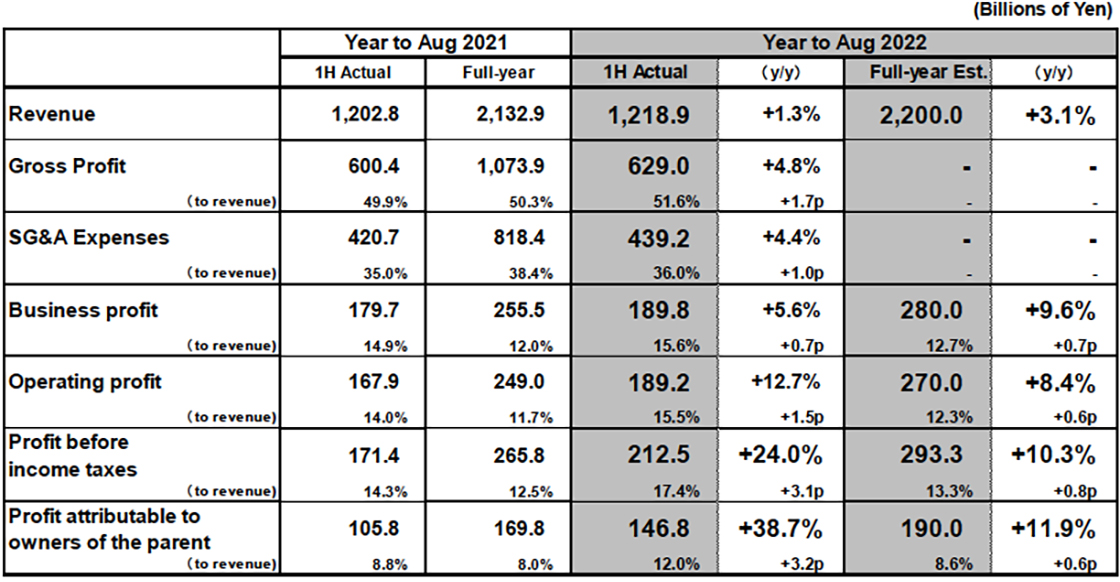

Results Summary Fast Retailing Co Ltd

Results Summary Fast Retailing Co Ltd

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Real Estate Taxation In Thailand Thai Property Group

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Public Revenue To Shrink To Rm227 3b In 2020 Amid Lower Tax Collection The Edge Markets

1 Nov 2018 Budgeting Inheritance Tax Finance

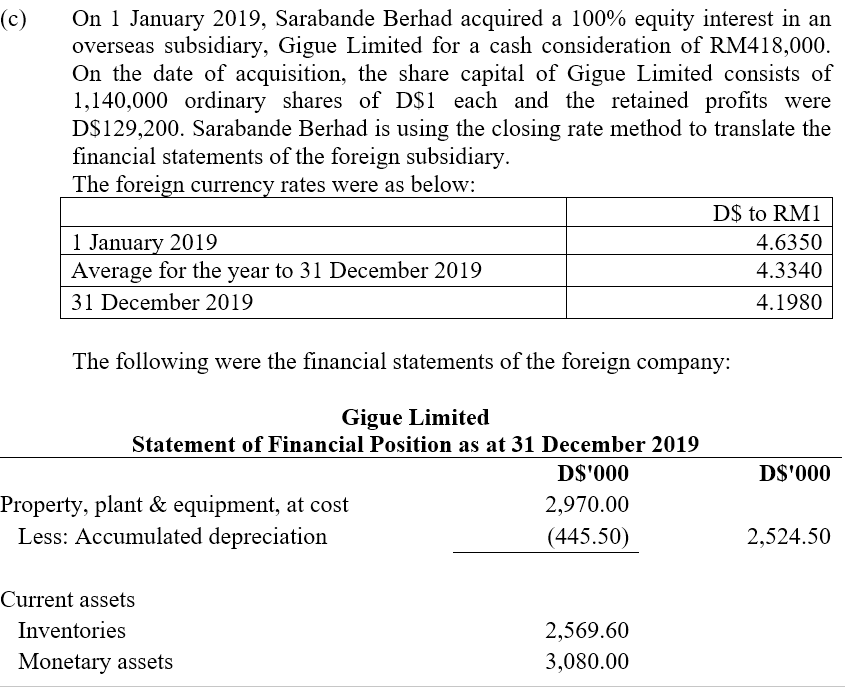

Solved A Rondo Group Berhad Makes Up Its Accounts To 31 Chegg Com

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting